Acquiring Module: Making Payments Easier and Smarter

Table of Contents

In recent years, face payments using Alipay’s Dragonfly and WeChat’s Frog became popular in China. These new technologies made things tough for traditional payment device makers, who were already struggling as banks and payment companies began to focus more on profits and less on expansion. The demand for payment devices dropped, and many manufacturers found themselves left behind.

While future payments will be based on real-life situations (called “scenario payments”), most hardware makers don’t really understand these use cases. Their machines are often outdated, hard to use, and no match for flexible software companies. But these software companies also face a challenge—they don’t have the experience to meet strict security standards set by organizations like UnionPay.

This is where the new acquiring module comes in.

In 2018, UnionPay launched a mobile POS system that changed the game. It turned smartphones into payment devices. Merchants could just download an app and start accepting both card and QR payments—no extra hardware needed.

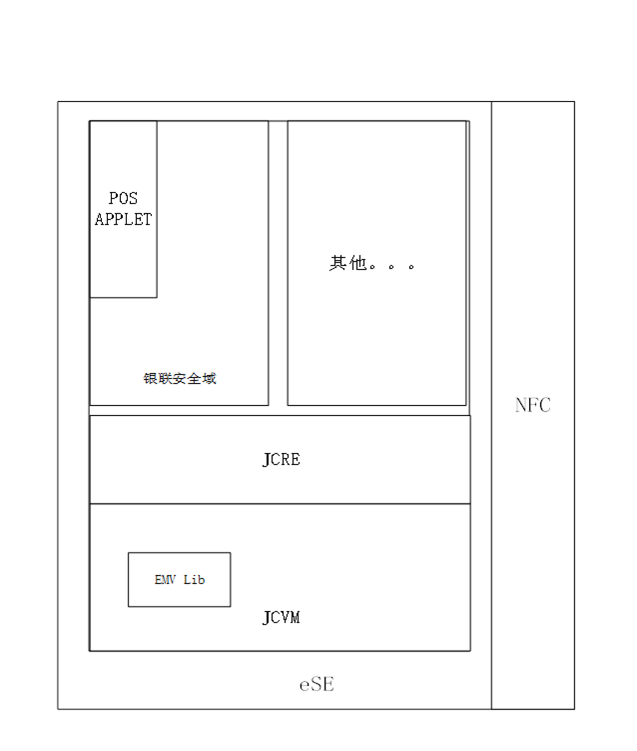

This dream of using a phone for all acquiring tasks is now closer to reality. Thanks to secure NFC + eSE (embedded Secure Element) modules like NXP’s PN80T, it’s possible to make low-value, PIN-free payments safely. The heavy security work is done in the module, so the software companies don’t have to worry about certifications.

How It Works:

The core EMV payment functions are built into the secure chip (eSE).

An app (POS Applet) stores keys and handles all payment steps.

Middleware software connects the applet to the outside device (like a phone, vending machine, or cash register).

Once connected to the cloud, merchants can process transactions using bank cards or QR codes.

Why It Matters:

No more expensive hardware—just a smartphone or smart device.

Easy and fast to set up.

Secure and approved by UnionPay.

Perfect for small businesses and services like vending machines, buses, delivery, retail, and even shared bikes.

With this acquiring module, software companies with strong customer-facing apps can now offer secure payment features too. This opens up huge possibilities and gives bank card payments a stronger role in the market—reducing the dominance of big players like Alipay and WeChat.

In short, this tiny module could reshape how people pay in daily life—simple, fast, secure, and open to everyone.